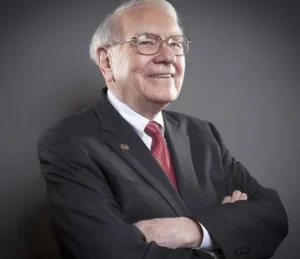

Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, is a household name in the world of finance. Often referred to as the Oracle of Omaha, Buffett’s investment strategies and financial wisdom have made him one of the richest individuals on the planet.

As we look ahead to 2025, many are curious about Warren Buffett’s net worth and the remarkable journey that has led him to such astonishing wealth. In this comprehensive article, Celebrity Pia will explore Buffett’s life, investment strategies, philanthropic efforts, and the financial empire he has built, while also delving into the astounding figure of his net worth projected for 2025.

Early Life and Education

Humble Beginnings

Warren Edward Buffett was born on 30 August 1930 in Omaha, Nebraska. Raised in a modest household, Buffett displayed an entrepreneurial spirit from a young age. His father, Howard Buffett, was a stockbroker and a member of the U.S. Congress, which exposed Warren to the world of finance at an early age.

By age 11, he had already purchased his first stock three shares of Citgo Petroleum and had developed a keen interest in investing.

Education and Influences

Buffett attended the University of Nebraska, where he earned a degree in business administration. Afterward, he enrolled at Columbia Business School, where he studied under the renowned economist Benjamin Graham, often referred to as the father of value investing.

Graham’s philosophy of identifying undervalued stocks based on their intrinsic value had a profound influence on Buffett’s investment approach. Buffett graduated from Columbia in 1951 and returned to Omaha, where he began his career in finance. His early experiences included working as a securities analyst and teaching investment courses at the university level.

These formative years laid the groundwork for his future successes in the stock market.

The Birth of Berkshire Hathaway

Acquisition of Berkshire Hathaway

In 1965, Buffett took control of Berkshire Hathaway, a struggling textile manufacturing company, and transformed it into a diversified holding company. Recognizing the growth potential, Buffett began acquiring companies across various sectors, including insurance, utilities, and consumer goods.

Buffett’s investment in Berkshire Hathaway marked the beginning of a revolutionary approach to business management. He implemented a decentralized management style that allowed acquired companies to operate independently while benefiting from Berkshire Hathaway’s financial strength and strategic direction.

Growth and Diversification

Under Buffett’s leadership, Berkshire Hathaway diversified its portfolio to include a wide array of businesses, such as GEICO, Dairy Queen, and See’s Candies. This diversification not only mitigated risk but also generated multiple revenue streams, significantly contributing to Buffett’s growing net worth.

The company’s unique structure, which allows different subsidiaries to maintain autonomy, has proven highly effective. Buffett’s hands off management style fosters innovation and encourages entrepreneurial spirit within the companies he acquires.

Warren Buffett’s Investment Strategies

Value Investing Philosophy

Warren Buffett is best known for his commitment to value investing, a strategy that focuses on buying stocks that are undervalued compared to their intrinsic value. This approach necessitates a thorough examination of a company’s financial health, competitive position, and growth potential.

Buffett emphasizes the importance of long term investment horizons. He believes that patience and discipline are key to successful investing. By focusing on high quality companies with strong fundamentals, Buffett has built a portfolio that has consistently outperformed the market.

Long Term Perspective

One of the hallmarks of Buffett’s investment strategy is his long term perspective. Rather than chasing short term gains, he advocates for a buy and hold strategy. Buffett famously stated, Our favorite holding period is forever. This philosophy reflects his belief in the power of compounding returns over time.

Rigorous Market Analysis

Buffett’s success is also attributed to his rigorous market analysis. He is known for thoroughly researching potential investments, examining financial statements, and assessing the overall economic landscape. This analytical approach allows him to identify undervalued opportunities that others may overlook.

Buffett also adheres to a set of investment principles that guide his decision making process. He prioritizes companies with strong management teams, a competitive edge, and a proven track record of profitability. This disciplined approach has resulted in a successful investment portfolio that continues to grow.

Notable Investments and Achievements

Early Investments

Buffett’s early investments included stakes in companies like American Express, Coca Cola, and Gillette. His investment in Coca Cola, in particular, has become legendary. Buffett began purchasing Coca Cola shares in 1988 when the stock was undervalued. Today, it represents one of his most profitable investments, with a significant portion of Berkshire Hathaway’s portfolio dedicated to the beverage giant.

Technology Investments

In recent years, Buffett has also made headlines with his investments in technology companies. His decision to invest in Apple Inc. is a notable example. Buffett recognized the company’s potential for growth and its strong brand loyalty, leading to a massive stake in the tech giant.

As of 2025, Apple’s performance has significantly boosted Warren Buffett’s net worth, showcasing his ability to adapt to changing market dynamics.

Financial Success Through Diversification

Buffett’s investment strategies have led to remarkable financial success for Berkshire Hathaway. The company’s stock has consistently outperformed the market, and its diversified portfolio has proven resilient in various economic conditions. Buffett’s ability to identify promising investments and manage risks has solidified his reputation as one of the greatest investors of all time.

Warren Buffett’s Philanthropy

The Giving Pledge

Warren Buffett is not only renowned for his investment acumen but also his dedication to philanthropy. In 2006, he made headlines when he announced that he would gradually give away the majority of his wealth to charitable causes. Buffett joined forces with Bill and Melinda Gates to create The Giving Pledge, an initiative encouraging billionaires to commit at least half of their wealth to philanthropy.

Focus Areas of Philanthropy

Buffett’s philanthropic efforts focus on various areas, including education, health care, and poverty alleviation. He has pledged significant sums to organizations such as the Bill and Melinda Gates Foundation, which works to improve global health and reduce poverty. Buffett’s approach to philanthropy reflects his belief in addressing systemic issues and making a meaningful impact on society.

Setting an Example for Billionaires

Buffett’s commitment to giving back has inspired other wealthy individuals to engage in philanthropy. His emphasis on using wealth for the greater good has fostered a culture of financial philanthropy among billionaires. Buffett’s influence extends beyond his wealth he encourages others to consider their social responsibilities and contribute to positive change.

Warren Buffett’s Net Worth in 2025

As of 2025, Warren Buffett’s net worth is projected to be around $120 billion. This astonishing figure places him among the wealthiest individuals in the world. Several factors contribute to this remarkable net worth.

The Performance of Berkshire Hathaway

Berkshire Hathaway continues to thrive under Buffett’s leadership. The company’s stock has consistently outperformed the market, driven by its diverse portfolio of successful subsidiaries. The growth of key investments, particularly in technology and consumer goods, has significantly bolstered Buffett’s net worth.

Successful Investment Portfolio

Buffett’s investment portfolio includes some of the most profitable companies globally. His strategic investments in blue chip stocks have yielded substantial returns, contributing to his overall wealth. The compounding effect of these investments over time has played a crucial role in increasing his net worth.

Economic Factors

Broader economic factors also influence Warren Buffett’s net worth. As the global economy evolves, Buffett adapts his investment strategies to capitalize on emerging opportunities. His understanding of market dynamics and economic principles enables him to navigate challenges and capitalize on opportunities for growth.

The Legacy of Warren Buffett

Inspiring Future Generations

Warren Buffett’s impact on investing and finance extends far beyond his wealth. His investment strategies, principles, and commitment to philanthropy continue to inspire aspiring investors and entrepreneurs worldwide. Many financial literacy programs incorporate Buffett’s teachings, emphasizing the importance of value investing and sound financial management.

The Buffett Effect

The Buffett Effect refers to the phenomenon where the announcement of Buffett’s investment in a company often leads to an increase in its stock price. This reflects the immense trust and confidence investors have in Buffett’s judgment. His name has become synonymous with savvy investing, and many look to him for guidance in the stock market.

A Lasting Influence on the Business World

Buffett’s influence on the business world is profound. His straightforward approach to investing, coupled with his emphasis on ethical practices, has set a standard for business magnates everywhere. As a public figure, Buffett has demonstrated that financial success can coexist with integrity and responsibility.

Trending FAQs About Warren Buffett’s Net Worth

What is Warren Buffett’s net worth in 2025?

As of 2025, Warren Buffett’s net worth is projected to be around $120 billion, making him one of the wealthiest individuals in the world.

How did Warren Buffett earn his wealth?

Warren Buffett earned his wealth through his investment strategies, particularly value investing, and his leadership of Berkshire Hathaway, which has grown into a massive business empire.

What are some of Warren Buffett’s investment strategies?

Buffett is known for his value investing philosophy, long term perspective, and thorough market analysis. He focuses on purchasing undervalued stocks and holding them for the long term.

Is Warren Buffett involved in philanthropy?

Yes, Warren Buffett is a dedicated philanthropist and co founder of The Giving Pledge. He has committed to giving away the majority of his wealth to charitable causes.

How has Berkshire Hathaway performed over the years?

Berkshire Hathaway has consistently outperformed the market, thanks to its diverse portfolio and Buffett’s strategic investments. The company’s success has significantly contributed to Buffett’s net worth.

What is the Buffett Effect?

The Buffett Effect refers to the phenomenon where Buffett’s investment announcements often lead to an increase in the stock prices of the companies he invests in, reflecting the trust investors have in his judgment.

What legacy does Warren Buffett leave behind?

Warren Buffett’s legacy includes his impactful investment strategies, commitment to philanthropy, and influence on future generations of investors and entrepreneurs.

Conclusion

Warren Buffett’s journey from a young boy with a passion for business to an iconic billionaire investor is nothing short of remarkable. As we approach 2025, his projected net worth of around $120 billion serves as a testament to his exceptional investment strategies and business acumen.

Celebrity Pia aims to provide insightful information on influential figures, such as Warren Buffett, showcasing not only their financial success but also their lasting impact on the world. Buffett’s story is one of resilience, wisdom, and a commitment to improving society through financial philanthropy.

As he continues to navigate the ever changing landscape of investing, his legacy will undoubtedly inspire countless individuals for generations to come. In a world where financial success is often measured solely by numbers, Warren Buffett reminds us of the importance of ethics, long term thinking, and the power of giving back.

His influence will continue to shape the investment landscape and inspire future generations of investors and entrepreneurs alike.